Achieving FinOps is a tall order: it demands a degree of organizational self-awareness that some companies are constantly battling for. Consider the predicament that many teams find themselves in: while their cloud environments may contain a number of small things that could be optimized, there are no single glaring mistakes that are consuming massive quantities of resources. Seeing the distributed nature of inefficiencies, many stakeholders simply dismiss the potential savings as not worth the effort.

This is where a significant competitive advantage can be gained for those willing to truly assess their own FinOps maturity, and find the holes therein. Everything about a FinOps maturity assessment aligns with the central pillar of cost optimization: inform. Without a deep-seated understanding of what you truly stand to gain, any FinOps project risks fizzling out before it’s even gained momentum.

Below we take a look at what the FinOps maturity model is, how to define and measure maturity, and what it takes to put together the FinOps maturity assessment itself.

What Is the FinOps Maturity Model?

The FinOps maturity model breaks down a relatively complex self-identification process into three main phases: crawl, walk, or run. This drastically simplified approach helps organizations gain a rough and ready insight into the stage they’re at – a particularly important tool when communicating across stakeholders.

For this, we’re using a framework set out by The FinOps Foundation: an industry group that focuses on sharing knowledge across the spectrum of FinOps maturity. This wide breadth of industry experience has helped develop a broad map of every organization’s journey.

The framework segments the process into three key phases:

The Crawl Stage

This early phase of FinOps maturity is defined by a new or developing interest in FinOps’ potential. While there may be an abundance of enthusiasm in this stage, it’s limited to the few who understand FinOps capabilities. This reflects the organization’s own structure, which may still rely on siloed teams to deliver day-to-day projects. As FinOps knowledge begins to spread throughout the relevant teams, a small number of team leaders may meet up and discuss a few key metrics – such as rough predictions of a project’s potential savings – and there may even be some basic KPIs put in place that focus on identifying how much cloud spend is allocated.

Ultimately, at the crawl stage, the mechanisms to make widespread savings are not yet in place. Instead, crawl-stage organizations are defined by their focus on low-hanging fruit.

The Walk Stage

While the crawl stage sees a lack of widespread understanding of FinOps capabilities, the walk stage is defined by a growing understanding of such. Automation and other processes are beginning to cover a large number of capabilities, but some difficult edge cases – even significant ones – are still being grappled with.

The Run Stage

Finally, if a FinOps capability is in the run stage, then it’s understood and followed to a high degree by all relevant teams throughout the workflow. Difficult edge cases are not just identified but proactively addressed. KPIs are high, and automation is managing almost every repeatable FinOps task within that capability.

Note that – while this maturity model can shed a lot of light on how much further you need to push your organization – you shouldn’t aim to universally push every capability into the ‘run’ stage. Sometimes, more automation doesn’t lend a palpable benefit – and don’t forget the time and resources spent on every project. Instead, let business value drive every improvement: if anomaly detection is at a walking stage, it might be best to focus your efforts on forecasting, if it’s lagging a bit.

The whole point of a FinOps maturity assessment is to find out precisely which area of FinOps would benefit the most from that extra attention.

How to Define and Measure FinOps Maturity

Aiming to optimize performance, cost, and speed, FinOps takes control back from opaque invoices: even better, the visibility measures put in place throughout almost always help on-the-ground cloud staff actualize higher cloud efficiency overall. But first, successful FinOps demands an understanding of your own organization’s architecture: no cookie-cutter formula magically cuts cloud spend by millions.

FinOps Capabilities: A Brick-by-Brick View

FinOps capabilities refer to the nitty-gritty, functional areas of activity that FinOps achieves. Each of these is a brick in your wider FinOps project, and a mature FinOps team will be able to achieve, or track, every one to some degree. The full breakdown – as according to the FinOps foundation – is as follows:

- Cloud Financial Management: Establishes the financial management of cloud spending, focusing on the principles of budgeting, forecasting, and optimizing cloud expenses.

- Cost Allocation: Implements tagging and resource attribution methods to accurately allocate cloud costs to the right teams, projects, or cost centers.

- Benchmarking: Compares performance against industry standards or historical data to identify areas for improvement and optimization.

- Budgeting & Forecasting: Develops and manages budgets for cloud spending, forecasts future costs, and implements measures to align expenses with business goals.

- Commitment Discounts: Leverages cloud provider discount mechanisms, such as reservations or savings plans, to reduce costs.

- Rate Optimization: Identifies and applies strategies to take advantage of the most cost-effective pricing options for cloud services.

- Usage Optimization: Focuses on reducing waste by identifying unused or underutilized resources and recommending adjustments to ensure efficient cloud usage.

- Chargeback & Showback: Implements processes to chargeback or showback cloud costs to business units, projects, or teams, promoting accountability and awareness of cloud expenses.

- Anomaly Detection: Uses monitoring tools to detect unusual patterns in cloud spending that could indicate inefficiencies or errors.

- Cloud Financial Operations (FinOps) Reporting: Produces reports that provide insights into cloud spending, trends, and optimization opportunities.

- Cloud Usage and Cost Trends Analysis: Analyzes trends in cloud usage and costs to inform strategic decisions about cloud resource management.

- Governance and Control: Establishes policies and procedures to ensure cloud spending aligns with organizational objectives and compliance requirements.

That’s quite the list: to find out more about each FinOps capability, see our guide here. Note that each capability exists on a spectrum of maturity, too. While each of these capabilities is necessary in some way when gaining more FinOps maturity, a wider scope is needed to help the implementation of each. Enter, focus areas, also known as lenses according to the FinOps Foundation.

Focus Areas: The Foundation of FinOps Maturity

FinOps maturity is built from the whole stack of FinOps capabilities. The framework of focus areas allows you to segment the breadth of these capabilities into manageable, bitesize pieces – specifically for a faster and more collaborative assessment process. In this way, think of capabilities as individual bricks – and focus areas as the walls and foundation of your FinOps maturity. Your FinOps assessment will examine each focus area in relation to each capability, and the way in which your organization is utilizing them.

- Knowledge: This focus point judges the depth of FinOps understanding and awareness within the target group. On a scale from 0 to 5, knowledge maturity begins at an essential nothing – that is, no discussions around a certain capability, with no one working to develop further knowledge – up to a 4, which means the target group is actively spreading awareness about the capability to other groups.

- Processes: Processes define two separate fields: the first is the set of actions that deliver the FinOps capability itself (such as the processes that take advantage of cloud discounts) and the artifact documenting these actions. A score of 0 means that there’s no consistent process in place at all; the highest score of 4 means that every process is transparent, defined, and universally established. Note that this may not mean there’s an individual process for every unique capability, just that every process is in place and iterated upon.

- Metrics: Note that this focus point won’t measure the actual score of every cloud metric – instead, it focuses on how these metrics are collected and implemented. A low score may mean that some key metrics are being tracked, while more mature metric collection sees KPIs put in place for the amount of metric data collected and linked directly to how close you are to overall corporate goals.

- Adoption: Adoption focuses on how widely a capability has been accepted. When at 0, the capability has simply not been touched yet – mature adoption at scores of 3 or 4 see fully established adoption, and regular engagement and iteration thereon.

- Automation: As a key component of long-term FinOps success, capability automation can be particularly lucrative. Similar to the prior maturity scores – when at 0, every capability is being managed manually. Primary automation sees a significant number of manual tasks be offloaded onto automated toolings, while a score of 4 sees every material and repeatable task be managed via automated tooling.

Having established the cross-functional lens through which your assessment will tackle the complexity of FinOps tools and culture, it’s finally time to start putting together the scaffolding of the assessment itself.

Stage 1: Define Assessment Boundaries

Establishing the scope of the assessment is a make-or-break component to your FinOps maturity assessment. As such, a number of key areas will need to be highlighted first. These will help keep your assessment within manageable confines, while keeping everyone on track.

Identify Target Groups

The target group covers the specific part of the organization that will be assessed. When first starting out, it can be easiest to focus on groups that naturally stand out. Don’t be too concerned if you’re only able to assess a few groups within a certain time period – it’s more manageable to work with a few select groups than trying to establish an average spread across lots of groups at hugely different maturity levels.

Target Scope

While the target group identifies the people you’re assessing, the target scope zooms in on the capabilities being assessed. Target scope should be heavily driven by what you believe the highest business value would be. For companies in the crawl stage, the highest value can be achieved by understanding cloud usage – for those more established, the highest-return scope can be performance tracking.

Similar to identifying the target group, it’s best to focus the assessment on fewer capabilities, rather than too many. FinOps benefits from incredible scalability – after some behaviors are established within your groups and toolings, it’s best to start thinking about scale. By combining the target group and the target scope, you’re able to get a full idea of the stakeholders and subject matter experts that are needed for the project. Keep in mind that the different capabilities required for this can necessitate their own deck of professionals: record stakeholder discussions, alongside the data they provide throughout the assessment.

Balance the Different Focal Points

The above focal points of knowledge, metrics, adoption and more are all vital to your assessment. However, it’s unrealistic to try and improve every single area all at once. Instead, prioritize the highest-return focal points across the groups and scope of this individual assessment. The end goal of an assessment is to determine whether there’s a minimum degree of knowledge, automation – or any other focus area – that isn’t being met. If you already have an understanding of what focus areas are lacking – or want to determine whether recent training has made an impact – don’t be afraid to tune the assessment and prioritize them.

Target Score

The target score aims to realistically set your goals across the different FinOps capabilities. When establishing these targets, think about the maturity you’ll genuinely be able to achieve across the different capabilities – after all, some new disciplines can be demanding – meaning they take more time to reach their target score.

Putting realistic target scores in place can help give a readily-understandable metric for progress that keeps the momentum of the assessment far into the improvement process.

Stage 2: Define Your Questions

With key stakeholders and goals identified, it’s possible to start developing your library of discovery questions. These are important, as they’ll help you build a score for each capability. Develop a library of specific questions that will best help gain insight, and consider the importance of open questions: any piece of evidence and data is important throughout these conversations. Gather as much documented proof as possible, as this will further help spark more conversations with other relevant subject matter experts.

Assessment Stage 3: Sit Down and Talk

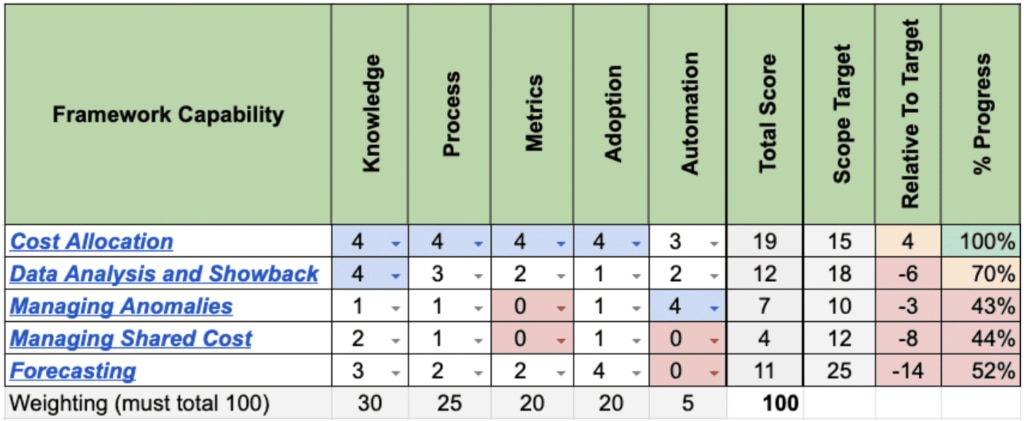

You’re now ready to go ahead with your assessment. Begin with a capability-by-capability approach, and aim to discuss how well each capability is being handled. For efficiency, try to group capabilities according to the group of stakeholders or professionals you’re talking to. The aim at the end of each chat is to have a table that scores each capability as a percentage of the group’s potential maximum – and an insight into how each focus area is helping or hindering that capability. For inspiration, take the following example from the FinOps Foundation:

Group conversations are particularly powerful in this, as it allows space for disagreements between SMEs. This allows for further identification of gaps in common knowledge or experience, and is itself a sign that the people you’re talking to are engaged and focused.

Each capability can then be assessed on a basis of focus points, according to business priorities for focus at that stage in the journey.

Assessment Stage 4: Outcome

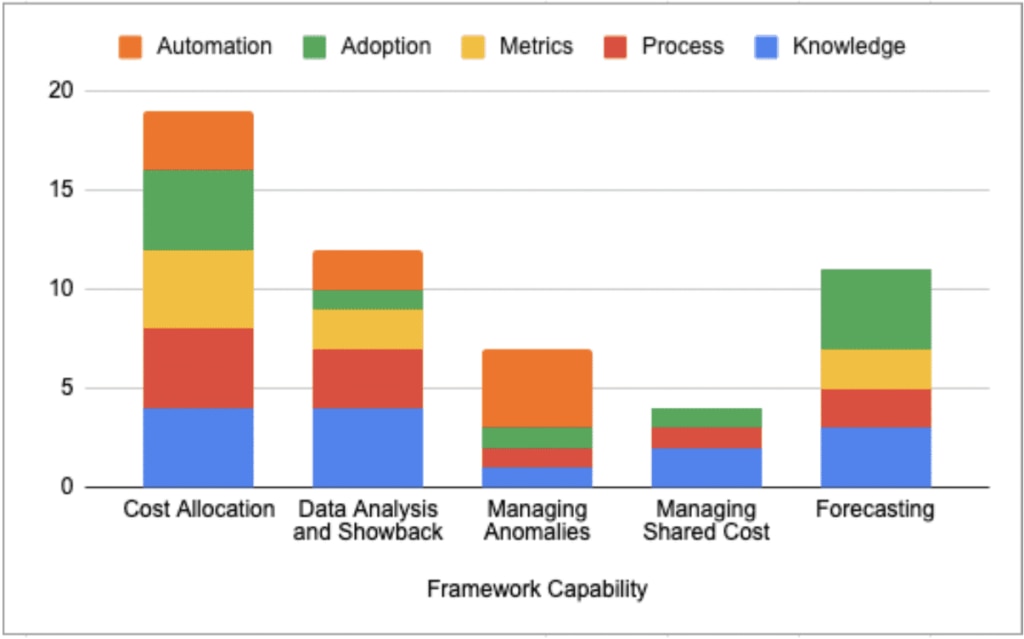

The graph below takes that example data and visualizes each capability’s scores, broken down by focus area.

For all focus points above, use the evidence gathered in conversation, while combining it with how mature the focus area is for that capability and scope, and select a maturity score for that area. Keep in mind that it’s best to be as consistent as possible throughout all scoring, and don’t lose track of a realistic, contextual goal for that capability.

In figure 1 above, it’s possible to quickly and easily see that the knowledge and process focus areas are fairly mature. Metrics and automation, on the other hand, are only just beginning to get going. Thanks to managing shared cost’s low overall score, it’s clear to see that there’s a real lack of tooling in that area. This is where the extra data collected throughout the conversation phase can help clarify and support any relevant findings.

These assessed components highlight precisely which areas are lacking, and which need the most effort going forward. This is why two previous actions are so crucial: evidence gathering discussions, and reasonable target scores – because these two data points will drive significant FinOps efforts.

Final Stage: Roadmap

The ultimate benefits of a FInOps maturity assessment are twofold: firstly, it provides a comprehensive oversight into the cultural and technical capabilities driving your real-time cost optimization; secondly, it builds a common understanding of where FinOps capabilities can be improved on.

These two qualities help build a realistic view into the next phase in your FinOps maturity roadmap.

You Don’t Have to Go Alone

Understanding the maturity model won’t spoon-feed FinOps straight to the relevant teams. The process still demands a substantial amount of dedicated time, work, and collaboration. Without a dedicated FinOps team, lower-maturity organizations sometimes risk being locked out of assessments for far too long.

To combat this, GlobalDots’ decade-plus of cloud experience can kickstart an in-depth FinOps assessment, navigate the cultural complexities of an assessment, and steer the FinOps craft toward cohesive success. Covering the bases of cloud spend allocation, process automation, and KPI implementation, you’re granted the reins to act precisely on the maturity assessment report that identifies the highest-return actions. GlobalDots’ cloud cost optimization solution goes one step further, with a suite of capability tools that help supercharge the progress you need.