Content Delivery Network platforms for the delivery of video and multimedia content acceleration, are on the rise. The new emerging technologies are busily developed and discussed among all the stakeholders – video content owners, service providers, telecom carriers and industry vendors. All are struggling for a flawless delivery of clips and video streams all over the world, at any time, as the user becomes more impatient, more mobile, more critical of services provided, and more picky.

Video CDNs implement servers that are dedicated to operating the delivery of video content. Video business models and technologies are changing fast, and are in need of new content acceleration methods constantly. Mobile video strategies are especially challenging, since more vendors are creating design responsive websites, concerned with optimal navigating experiences in any environment.

How One AI-Driven Media Platform Cut EBS Costs for AWS ASGs by 48%

Now, the users use the web in a way that more resembles watching a media from a TV channel, they are taking up video lessons, making their own video courses. All the advanced plugins and decoders, popular TV episodes available online, webcasts, famous talks, did their toll for video industry vendors – and gave them clients who won’t choose to – wait.

A copy of a streamed video doesn’t exist on the end user’s computer, and thus the streaming file that is loaded on the player differs from an ordinary file loaded from a computer system. The servers used for video streaming are using compression and decompression software to get rid of the unnecessary data.

Instead of purchasing a streaming server, content providers are more decided on paying a service provider to host the video “on the cloud”, and are leaning on a network of surrogate web servers distributed across different data centers in different geographical region, or content delivery network for the video. The varying round-trip of the video content/data needs to be optimized, as well as the compressing/decompressing methods, to minimize latency and provide the best possible quality of “the flick”.

Largest Contributor to CDN Revenue

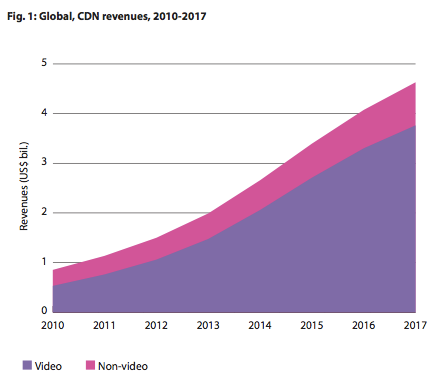

According to Informa T&M report, much mentioned in our blog recently, video content delivery (colored purple on the image) will be the largest contributor to commercial CDN revenue growth, accounting for 81% of total revenue in 2017.

CBS report predicts the video portion of CDN market to reach about $1 billion by the end of 2015. The attached image for the market for commercial CDN services from Informa & Telecom, predicts double or triple the revenue by the end of 2015, up to $3 billion. Finally, it is expected to reach almost $5 billion by the end of 2017.

Online video ecosystem is extremely elastic and while the traffic created by video delivery is one of the fastest growing segments of the overall Content Delivery Network industry, it is also the most elusive market to stakeholders when it comes to pricing and trends.

New CDN video delivery models are constantly emerging, e.g. Netflix building their own content delivery network, Open Connect. Netflix’s platform allows network operators to provide higher quality streaming and gives them control over the video that flows through their pipes. Open Connect is serving the “vast majority” of Netflix video in Europe, Canada and Latin America. This sort of enterprise built CDN platforms are to be expected more of in the near future.